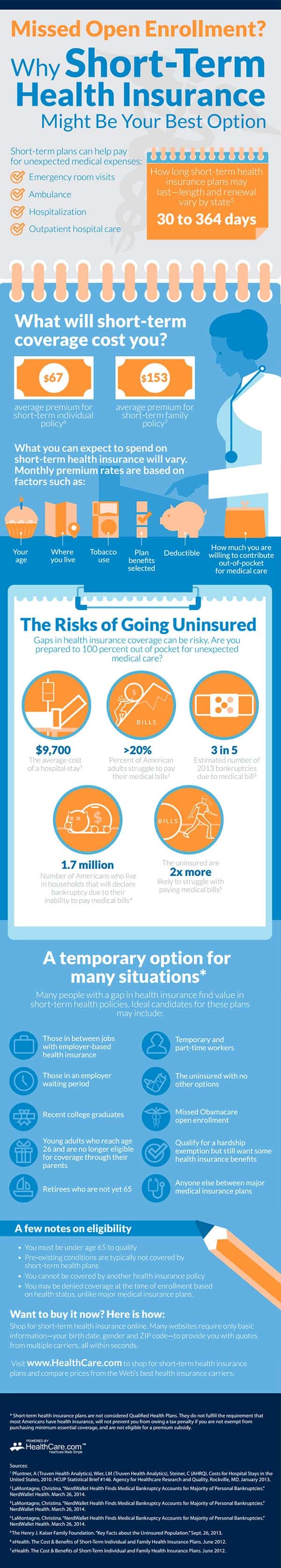

I am a young adult and soon to be health insurance holder. I’ve always relied on my parents’ health insurance for my trips to the hospital and all that jazz, but soon it will be up to me to pick and choose my health insurance. I’m not sure exactly how it all works, but from the looks of the infographic below, short-term health insurance might be the way to go. At least for those of us who have found ourselves in a health insurance gap. So if you’re in a similar situation, or you’re just curious, stick around and learn something new!

Short-term health insurance can cover anywhere from 30 to 365 days, depending on what state you live in. Some of the benefits to having this type of insurance include coverage for unexpected trips to the ER, hospitalization, or ambulance rides. It’s also fairly inexpensive. The average premium for an individual with short-term health insurance is $67. For a family policy, the average is $153. All of these costs vary depending on certain attributes such as age, where you live, tobacco use, and all that good stuff.

To be without health insurance is a risky business. So if you’re in one these gaps, it might be best to just sign up for the short-term policy. Without it, if you are injured or have to visit the hospital for any reason, you could find yourself in serious debt. And that’s no bueno, my friends. The average cost of a hospital stay is $9,700, which is insane and definitely more than I can shell out. I mean, an estimated 3 in 5 bankruptcies can be attributed to medical bills. So get insured now while you’re still fully functional. You never know what tragedy lies around the corner, underneath the ladder, across the street from the black cat, sitting on the broken mirror. [via]