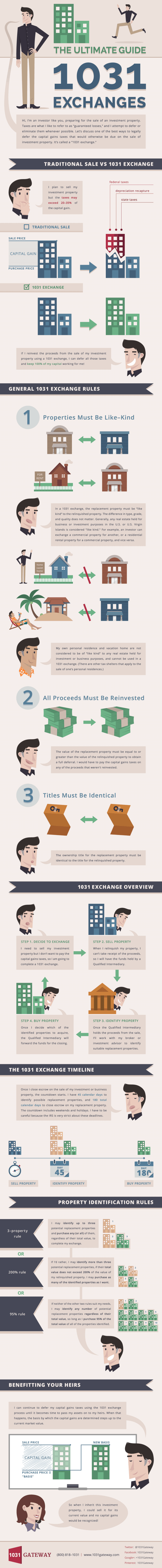

Today’s infographic is for all of you real estate savvy individuals out there, and those who are thinking of selling a piece of property or business in the future. There may be a way to defer some of your capital gains taxes on your valuables if you do plan to sell. This tactic is called a 1031 Exchange.

In a 1031 Exchange, money from the sale of an investment property can be put towards another “like-kind” property. This means that an investor can exchange a commercial property for another, or a residential rental property for a commercial property. But, be careful! This deal is time-sensitive. You only have forty-five days to identify possible replacement properties, and one hundred and eighty days to close escrow on the actual replacement property. (The IRS is very strict about this timeline.)

And unfortunately, your own personal residence or vacation home cannot be used in the 1031. These properties are not considered to be of “like kind” to any real estate held for investment or business purposes (even if you conducted business from inside your home).

Check out the detailed guide below to sell as smartly as possible! Your heirs just might thank you. [The Ultimate 1031 Exchange Guide]